“C’mon, it’s just $5…what’s the big deal?â€

How many times have you said that to yourself and then blown $5 on something that added little if any long-term value to your life?

If you’re like most people, the answer is — plenty of times!

But imagine if you could say “no†to yourself just once a week and redirect that money in your life.

That’s all it takes to begin the $5 savings challenge. If completed successfully, it will result in you having nearly $7,000 by the end of the year!

Read more: How much you can save in 2017 by starting with just $1 a week

Introducing the $5 a week savings challenge

Over the past week, we shared a separate savings challenge that started with you socking away $20 during the first week of January and upping the amount from there. Within a month, that plan had people saving over $100 a week — if they could manage it.

A lot of people balked and said they’d find it easier to do a savings challenge if it just weren’t so extreme. So for all of you, we present the $5 a week savings challenge!

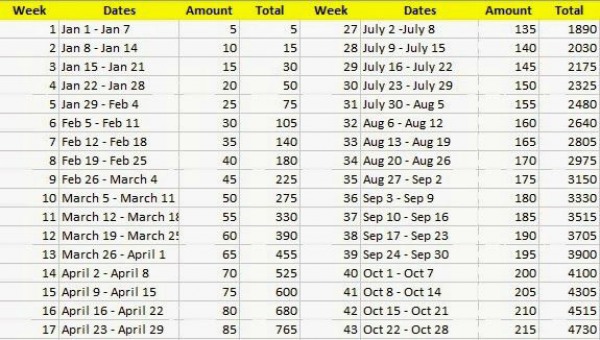

This chart below from KuriPotpinay.com show how it all starts with socking away just $5 during the first week of January. Everybody can do that, right?

Then during the second week, you save $10. And during the third week you save $15, and on and on…

This plan eases you into the idea of progressive saving, where you’re raising your savings amount by $5 each week. But it happens at a slower pace that more people would be inclined to stick with versus the other savings challenges that start out all guns blazing.

If you keep upping your savings rate by just $5 more each week, you’ll have nearly $7,000 by the end of the year!

Of course, the devil is in the details. While it might be easy to stash away a few bucks early in the year, how about when you get toward the middle and end of the year? You’ll have to come up with anywhere from $100 to almost $300 on a weekly basis under this plan.

But don’t despair…it is possible! Here are a ton of ways to reduce your bills or create more money in your life — broken down by category — so you can successfully complete the $5 savings challenge in 2017!

Groceries

Buy three copies of the Sunday newspaper

You want the glossy RedPlum and SmartSource coupon circulars. As an alternative, you can always visit RedPlum.com and SmartSource.com to print coupons for free. And if you live in a metro area, you may be able to find free Spanish language newspapers in your town that have these inserts. (Be sure to leave copies for others too!)

Do this to get additional coupons for organics

When it comes to getting organic food coupons, one of the best ways is to contact the manufacturer directly. If there’s a brand you particularly like, consider writing them an e-mail or a letter to express your appreciation for their product and to ask about coupons. People report scoring coupons from natural brands like Stonyfield and Applegate Farms this way.

Another method is to visit online organic coupon clearinghouses. Several sites specialize in coupons for natural and organic foods. Crystal Collins of NaturalThrifty.com maintains a list of online organic coupon resources here.

Know how to maximize your coupons

Once you’ve gathered all your coupons, it’s time to figure out how to maximize them. Visit a site like CouponMom.com that breaks down the weekly sales by state and explains which coupon to use where and when for maximum savings.

Shop with the right app

Coupons have moved so far beyond the physical kinds these days. Today you can get deals and coupons right on your smartphone at the click of a button. Try playing around with these free apps to get started:

- Cellfire – Sends coupons directly to your loyalty cards.

- Coupons – Add grocery and drugstore coupons to your store loyalty cards and automatically save when you use them at the register.

- Favado – Aggregates sales data for your local grocery, drug and big box stores. Compare and save up to 70% on everyday items.

- GroceryIQ – Create and organize grocery lists quickly and easily.

- Ibotta – Earn cash every time you go shopping.

- Key Ring – Digitizes all your loyalty cards and stores them on a smartphone so you never have to fumble for the physical cards again.

- Out of Milk – Keep track of your shopping needs and your pantry’s inventory, and manage your to-do list items.

- SavingStar – Get grocery and food coupons, which convert into store savings or actual cash back.

Know your prices

Tracking the prices of your top 10 items for a month and a half or so. If you know the regular prices of your 10 most common purchases at local stores, then you’ll really know when to stock up on something when it goes on sale. If you have a coupon at that point, so much the better!

Be flexible

Brand loyalty will cost you money. If you have a coupon for a brand you’re not familiar with, why not give it a try and see if you like it? You may be surprised.

Sign up for loyalty programs

You can get greats savings through gas reward programs like the one Kroger offers and other similar plans at other grocers. But the real strength of loyalty programs may be something you don’t even think about: Because retailers are tracking your purchases through your loyalty card, they can quickly contact you in the event that some kind of foodborne illness is spreading through something you bought at their store. This could save your life!

Shop salvage stores

Want deeply discounted groceries? Salvage stores that offer “unsellables†like canned food that’s past its expiration date can be a great source of savings. Find the nearest salvage store in this directory. Of course, salvage stores are not for everybody; many people will balk at the idea of buying damaged goods. But Dr. Ted Labuza, a professor of food science at the University of Minnesota, told The Atlantic, “Foods can remain safe to consume for some time beyond sell-by and even use-by dates provided they are handled and stored properly.â€

Scour the clearance rack

Talk to your store’s manager and find out where they keep the clearance items. Many stores will have a dedicated rack or shelf. It’s also helpful to know when new stock is added to the clearance rack or aisle. If you’re first to find it, you can score some real deals!

Pay attention to unit pricing

Paying attention to unit pricing in the supermarket can be your ally at time when manufacturers are trying to sneak by reductions in the amount of product they’re selling you. Here’s a common scenario you might encounter in the supermarket: You’re buying the store brand of something like toilet paper and you’re confronted with the choice of either a big package or a little package. Which is a better value? Most people would think the larger package because you’re buying in bulk, right?

Not so fast. Look at the small unit price numbers, not the actual price. The large package may have a unit price of 70 cents per 100 sheets of toilet paper, while you the smaller package has a unit price of 55 cents per 100 sheets. So the smaller package actually offers more value for your dollar, in this case. This varies widely by product, so take a closer look to find the best deal.

Change where you shop

If you’re not shopping at Aldi or Walmart for your groceries, chances are you’re throwing money away. Aldi claims to save shoppers 50% off traditional supermarket prices. Walmart, meanwhile, is generally 20% to 30% cheaper than comparable supermarkets.

Shop with the right card

Speaking of Aldi, now that they accept credit cards, you might consider getting this card: The American Express Blue Cash Preferred Card offers 6% cashback on groceries, up to a max of $6,000 annually. Be sure to pay your bill in full each and every month!

Try out Upromise at checkout

Upromise lets you register your grocery and drug store loyalty cards, and then activate the service’s eCoupons. Use one of those coupons at checkout and you’ll get money for qualifying grocery store purchases. That money can be used to pay down your student loan, save for a child’s college and more.

Health care

Consider a virtual visit

Though telemedicine has been around for about 15 years, it is just now starting to gain some traction. See if it would make sense for your life.

Hire a medical billing specialist as an advocate

According to some estimates, roughly eight in 10 hospital bills have multiple errors. Hiring a medical billing specialist can save you the money and headache of fighting with the health care provider over something that you believe has been incorrectly billed.

Use free tools to know what you’re going to pay before you go under the knife

You don’t have to face a future of unknown bills when using your insurance for a medical procedure like an operation.

Check out this free service that allows you to research the cost of a particular procedure at your doctor of choice based on the insurance you have!

Choose a nurse-in-a-box clinic instead of an ER

One of the most expensive places to get medical care is in the hospital emergency room. There’s a much better alternative if you need medical care when your doctor’s office isn’t open: It’s those retail clinics typically located in drug stores, discount stores or supermarkets. See how much money they can save you vs. the ER.

Consider a faith-based program

You would have to be a member of a particular religious group to qualify. Watch Clark discussing this option.

Use an app to help you shop for the best prescription prices

Free apps like GoodRx and LowestMed are so popular because you can easily search nearby pharmacies for discounts and coupons that you didn’t know existed.

Auto insurance

The start of a new year is a great time to shake the dust off your budget and look for some areas where you can save big bucks.

Car insurance is one of those things where you could be paying more than $1,000 annually than you need to — just because you haven’t shopped the marketplace in a few years. Getting a better policy is easy. Here’s how to start…

Begin by identifying solid companies

Clark has long talked about the merits of Amica Mutual and USAA. But those aren’t the only two companies you should look at. Consider buying a one-time subscription to Consumer Reports and checking their latest list of the best auto insurance companies to find others that should make it onto your shortlist.

Get your quotes

Once you have a list of candidates, you’ll want to start getting quotes. This typically takes around 15 minutes on the phone. Have your most recent policy in front of you in case any questions come up about the make and model of your vehicle(s).

Working with an insurance broker is another option. He or she will get multiple quotes for you and you’ll have access to all the insurers they do business with. It’s an easy one-stop shop that lets you still have the flexibility of comparison pricing.

Once you get the quotes back, it’s time to compare them. Each quote should be based on the same amount of coverage so you can do an apples-to-apples comparison.

What if a poorly ranked company offers you a great quote? Clark says to avoid them! While the premium might be tempting, you want to be sure your insurer is there for you when the chips are down.

Know when to drop comprehensive and collision

The general rule is when the cost of comp and collision exceeds 10% of your old vehicle’s value, that’s the time to dump it and just have liability coverage. You can determine your vehicle’s value at Edmunds.com, KBB.com or NADA.com.

So let’s take a simple example. Say your vehicle is worth $4,000. If you’re paying anything more than $400 annually (that’s 10% of $4,000) for comp and collision, it no longer makes any financial sense. One notable exception to this rule: If there’s no way you could financially cover the loss of your vehicle, forget the math and keep paying for comp and collision.

Be prepared to take a higher deductible

You should always opt for a $1,000 deductible for the best savings on your policy. At that level, you’ll pay a lower premium and won’t be tempted to file any small piddling claims.

Don’t forget to ask about discounts!

The Insurance Information Institute reminds you that there are a ton of different discounts out there. Here are some you can ask about:

- Anti-theft devices

- Multiple policies with the same company

- College students living away from home

- Defensive driving courses

- Drivers ed courses

- Low annual mileage

- Long-time customer

- More than one car

- No accidents in three years

- No moving violations in three years

- Student drivers with good grades

Home energy savings

Paying a high energy bill every month is like throwing your money away. Don’t do it!

Follow this advice to save money at your home…

Change your light bulbs

Changing out your bulbs is like minting money. If you take a single 40-watt incandescent traditional bulb and replace it with a comparable LED bulb, you will save $4.10 annually (based on three hours of daily use.) It’s easy to find an LED for around that price, so payback time is just one year. After that, it’s all profit back in your pocket! Play around with Cree’s savings calculator to customize a scenario for your home.

Use a programmable thermostat

Programmable thermostats can reduce heating and cooling costs in your home by 25% or 30%. The Nest thermostat is one of the most popular ones.

Get rid of your second fridge

Nearly 1 in 3 of us have a second refrigerator in our homes, according to The Washington Post. When we buy a new fridge, we often take the old one and put it in the garage or the basement instead of ditching the thing. A lot of us think, “Hey, now we can buy more frozen foods when on sale.†But the reality is older fridges consume massive amounts of electricity. The cost of running a new fridge is next to nothing; older ones, though, can be hundreds of bucks a year to run. So that money you think you’re saving buying food on sale, you’re actually spending on your electric bill!

Use the microwave instead of the oven

Opt for the microwave when you just want to reheat something small like a soup or piece of pizza. You’ll save up to 80% of the energy you would use if you went with the oven method, according to the federal government’s Energy Star program.

Additional quick tips to save money on energy:

- Seal drafts around doors and windows using weather stripping or caulking.

- Make sure your attic is well insulated.

- Get a water heater blanket if your unit is over 5 years old.

- Use natural sunlight for heating when available.

- Make sure your vents are not blocked by furniture.

- Try zoned heating and cooling. Close off rooms and vents in rooms that are not in use.

- Close off your fireplace and the flue on your chimney.

- Consider warming your bed with an electric blanket on chilly nights.

Read more: Why you should consider making January a ‘no buy’ month

This new Netflix upgrade saves you money!

Best of the Week

-

The best deals of the Lowe’s Spring Fest Sale!

-

40+ of the best deals for Earth Day 2024

-

The best deals of The Home Depot’s Spring Black Friday Sale

-

The best deals at Amazon right now!

-

The best deals on grills right now

-

The best deals on laptops right now

-

The best deals on TVs available now

-

Here are the best Walmart deals happening now!

-

The best patio furniture deals right now